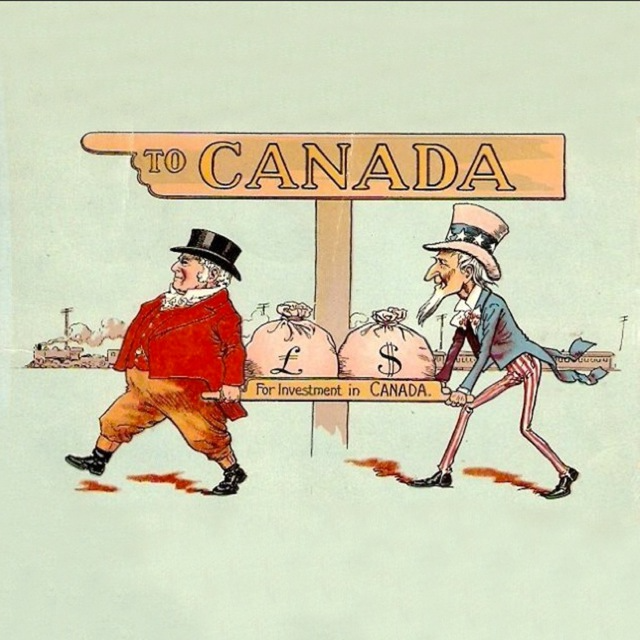

Финансы в Канаде

-

CIPF does not provide protection against any other type of risk or loss. If you have an account with a member firm, and that firm becomes insolvent, CIPF works to ensure that any property being held for you by the firm at that time is given back to you, within certain limits. Client property can include securities and cash.

-

Does CIPF Guarantee the Value of your Investment? No, it does not. CIPF’s role is to ensure that clients of an insolvent member firm receive their property held by the member firm at the date of its insolvency. For example, suppose you buy 100 shares for $5000, and these shares are held for you in an account with a CIPF member firm. If your CIPF member firm becomes insolvent, CIPF’s objective is to ensure that the 100 shares are returned to you. CIPF does not protect or guarantee your initial investment of $5000.

-

т.е. на пенсию вы больше 300-500к не планируете собирать? Т.к. CDIC страхует максимум 100к в каждой из 7 категорий, а все категории собрать нереально :)

Более того, доходность по депозитам редко выше инфляции, т.е. вы в лучшем случае ничего не потеряете (а скорее всего всё-таки потеряете на инфляции)